Discover How You Can Legally Reduce Your Federal Taxes by 30%–50%

We specialize in helping doctors, dentists and medical practice owners keep more of what they earn by applying proven, IRS-approved tax strategies tailored to your situation. Stop Overpaying in Taxes!

Apply below to see what tax savings you qualify for...

No stress, no guesswork — just clear, ethical tax relief tailored to you.

tailored specifically to healthcare professionals.

Every year, thousands of medical and dental practice owners hand over 30%–50% more to the IRS than they legally should. Why? Because they don't have a proactive tax strategy designed for healthcare professionals. We specialize in helping doctors, dentists, and medical practice owners legally reduce their federal taxes using proven, IRS-approved strategies tailored specifically to healthcare practices.

Empowering You To Live Boldly And Securely

We combine advanced tax strategy and planning under one roof to deliver solutions that protect and grow what you’ve built. With accountability, proactive service, and a standard of excellence, we help you live an Epic life with clarity and confidence. Year-round, proactive strategies to manage brackets, timing, deductions, and entity choices. We integrate planning with investments and cash flow to help you keep more—this year and every year.

Your Tax Strategy Session Includes:

In-Depth Review of Your Current Tax Situation — uncover missed deductions & savings opportunities specific to medical and dental practices.

IRS-Approved Tax Planning Frameworks for Healthcare Professionals — tailored strategies to reduce your federal tax liability while navigating practice-specific complexities.

One-on-One Consultation With an Expert — personalized to your practice structure, revenue, and goals.

Actionable Plan You Can Use Immediately — clarity, confidence, and compliance year after year.

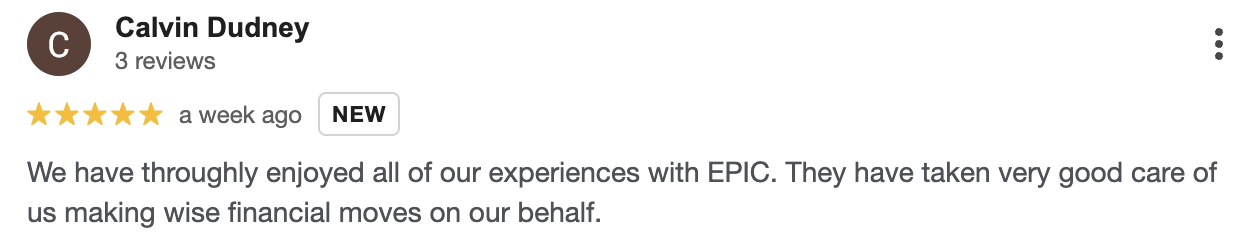

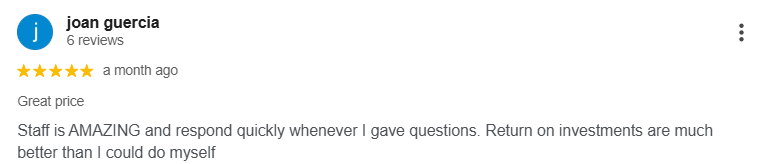

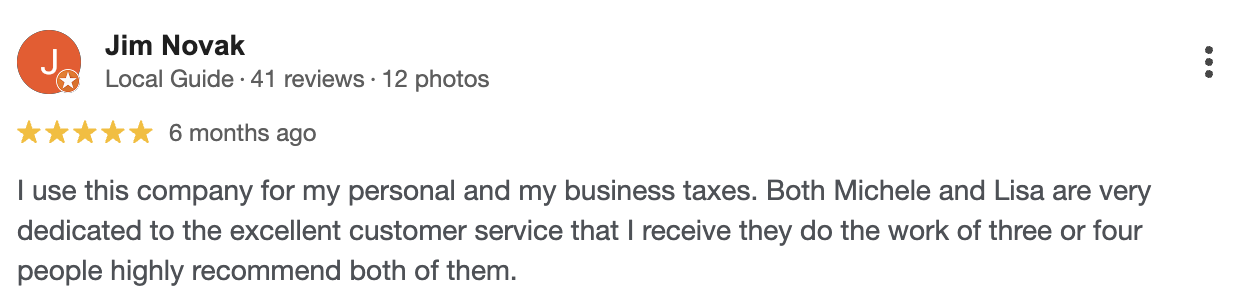

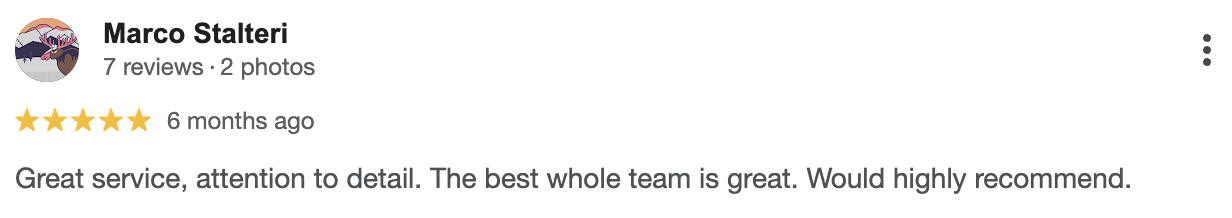

Client Reviews